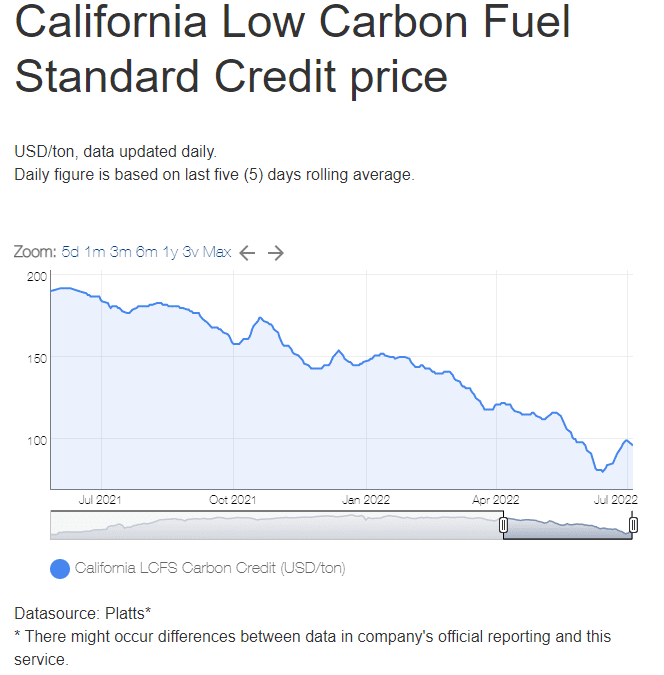

Are you wondering if LCFS credit prices make the investment in clean fuels worth it? At e-Mission Control, our core competency is enabling access to clean fuel programs for fleets currently electrifying or considering electrifying vehicles and equipment. California’s Low Carbon Fuel Standard has long stood as the champion and a template for a successful, market-based tool in regulators’ pockets to move the needle on limiting greenhouse gas emissions, reducing fossil fuel dependence, and lowering clean fuel costs, all without the need for deploying public funds. However, credit prices have been plunging, about 50% in the last year, and we’re here to evaluate why.

According to the latest market pricing on ICE, LCFS credit spot prices stood at $93/ton on July 1, 2022. This is an increase from $80 on June 14, 2022, but a dramatic drop from $185/ton on July 1, 2021, just one year prior. In 2020, credits were trading at $200.

An LCFS credit is issued per one metric tons (MT) of carbon (CO2) equivalent reduced, often referred to as “one ton.” Approximately 5.62 million MT of credits were generated in Q4 2021 compared to 4.64 million MT of deficits, according to the California Air Resources Board (CARB). That’s a 0.98 MT surplus of credits. But why does a credit surplus matter? Let’s dive a little into the LCFS program and how it works.

The Low Carbon Fuel Standard (LCFS) in California is a market-based program designed to reduce emissions, increase fuel supply independence, and lower clean fuel costs in the transportation sector.

According to the California Air Resources Board (CARB), transportation is currently responsible for

The LCFS is designed to reduce the carbon intensity (CI) of transportation fuels such as diesel and gasoline by 20 percent by 2030 while at the same time providing various low-carbon and renewable alternatives. The ultimate goal of the LCFS program is to eliminate unclean fuels in the California transportation sector.

The LCFS program aims to encourage the use of cleaner fuels such as:

by providing a market incentive to create demand for cleaner fuels in the marketplace.

Businesses that create or use fuels that are cleaner than the annual carbon intensity (CI) limit set by CARB can generate credits, while higher carbon intensity fuel manufacturers or importers create deficits. Additionally, a fuel producer may generate credits to offset their own deficits by, for example, producing renewable diesel as well as petroleum diesel.

LCFS is now over a decade old. It was implemented in 2011 in California and has inspired nearly identical legislation in Oregon and Washington. Since the LCFS program is market-based, like all markets, it fluctuates according to the actions of buyers and sellers.

While it’s difficult to attribute such sharp movement to any one particular influencing factor, ramped up production of renewable diesel and bio-CNG, and decreased demand for high-carbon fuels due to reduced travel and supply chain issues have certainly had a meaningful impact on credit price. The production volume of renewable diesel has increased by 35% in the last twelve months and bio-CNG has attained ultra-low carbon intensity scores (much lower than ever thought possible) together currently account for 45% of recent credit generation.

Depressed volume of high-carbon-intense fuel consumption (and therefore less deficits created) due to ongoing COVID restrictions and other socio-economic reasons decreases demand for credits, lowering their price in the market.

Depressed LCFS credit prices have certainly caught the eye of state regulators, who are hearing it from all sides about the ability to shore up private financial support of clean-fuel projects if LCFS pricing is down. During recent planning meetings, we have heard that California regulators may try to boost credit prices by steepening and lengthening current carbon-intensity (CI) compliance targets, even those prior to 2030. This is in addition to potential caps on feedstock types (i.e. soy-based feedstocks for renewable diesel), more scrutiny on CI applications, and other ways to limit credit supply and increase demand.

e-Mission Control believes that electrification is undoubtedly the way of the future and this will be reflected in the future LCFS credit price, and those implementing near-term electrification strategies will be rewarded in the long-term. For people who are already enrolled in the LCFS program, lower-priced LFCS credits are still money in your pocket.

“Maintain the course. Electrification is still the way of the future and we’re long on clean fuel programs like the LCFS to support the world-wide transportation energy transition,” said e-Mission Control CEO Todd Trauman.